Added coverage for rideshare drivers with companies like Uber.

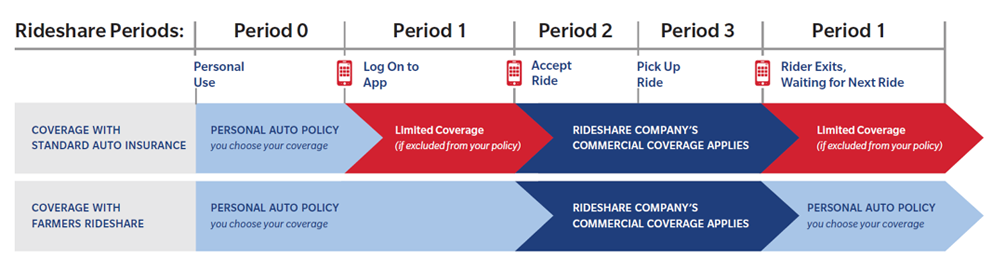

If you are driving with a rideshare company like Uber, and using your personal car for commercial work, this may create an unexpected gap in your auto coverage. Here’s how that can happen:

- There’s a good chance your personal auto policy excludes coverage when you’re logged into a rideshare company’s app as available to accept rides.

- The rideshare company’s full commercial liability coverage probably doesn’t begin until you accept a ride.

So, while you’re waiting to be matched with your next rider, there’s a good chance you’re only covered by a rideshare company’s limited liability coverage*. This often covers medical expenses and damage you cause to others if an accident is your fault — but won’t typically cover damage to you or your car.

Pace Insurance and Financial Services Rideshare

With Pace Insurance and Financial Services Rideshare, you can fill this gap when you’re logged into the rideshare company’s app but haven’t accepted a ride.